|

|

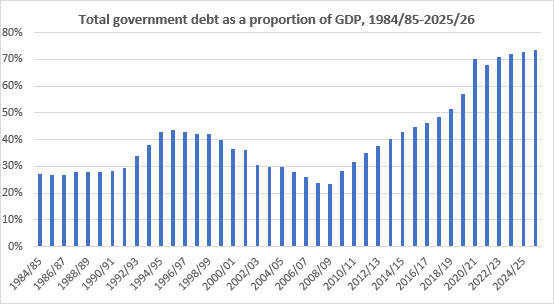

Dear Friend of the IRR, This month, leading up to the annual Budget Speech, we're reflecting on how the government manages South Africa's money. Today, we look at the state of our government's debt, it's consequences for our country, and a plan to get out of it. The SA government spends R1 billion per day on debt Public debt is the total amount of money the government owes because it has been overspending for many years. During the first half of South Africa's democratic era, we saw a dramatic improvement in public debt. The total government debt-to-GDP ratio decreased substantially, dropping from 42.7% in 1994/95 to 24% in 2007/08. However, from 2007/08 onwards, the Zuma-led government opened the spending taps and debt rose rapidly. Debt continued growing under President Cyril Ramaphosa, with a substantial jump during the Covid-19 pandemic. Public debt has risen from 24% of GDP in 2007/08 to over 70% of GDP now, effectively tripling to reach a projected 72.2% in 2023/24.

Source: South African Reserve Bank (SARB), Own Analysis Public debt directly impacts your life. Currently – and for the next three years – the government has to repay its debt at a rate of R1 billion – per day! That is R1 billion every single day that is unavailable to patch potholes, maintain water treatment works, fix streetlights or get the trains running again. It is R1 billion a day that is unavailable to improve public hospitals, upgrade classrooms, or eliminate pit latrines at schools. Instead, this money must be repaid to banks and wealthy lenders who bailed the government out when it didn't have enough to keep up with its own overspending. Growth will get SA out of debt To get out of this debt, the government has two options: spend less, or collect more money. Neither option is easy. No politician wants to cut spending by reducing social grants or fighting with public sector workers to reduce the public wage bill. Increasing revenue by squeezing the small and already overburdened tax base is unsustainable. The government may be tempted to print more money to pay its debts, but we all know that will lead to disaster – just look at the high inflation and subsequent currency collapse and economic devastation experienced in countries like Zimbabwe and Sri Lanka. The only way to get out of the debt hole is through rapid economic growth. Some in government – in the Treasury and the Reserve Bank, for example – understand this. But most government officials think they can just keep spending and borrowing and that nothing bad will happen. That is why the IRR will make very clear this year that the choice for South Africa is growth or bust, while explaining what policies we need to get growth. Read the IRR Growth Strategy for South Africa, which sets out a clear formula for fast economic growth. What can you do about it?

Vote wisely by supporting political parties committed to fiscal discipline and rapid economic growth.

|

|

Become a friend of the IRR |